Disability Insurance Overview and How we can Hedge Risk with Different Designs

Summary and Statistics

Long term disability insurance protects an individual’s earnings if a disability prevents the individual from working for an extended period of time. This type of coverage replaces lost income, in order to cover key expenses such as a mortgage or rent, utilities, groceries, retirement savings, and other financial obligations. Some key statistics regarding disability to mention are:

Currently disabled workers in the workforce is about 14%.2

1 in 4 workers will experience a disability, at some point in their career, before retirement.

The average disability duration is 2 - 2.5 years.

Those who review long term disability insurance, are doing so for important reasons::

They have no coverage through their employer.

Their employer does provide coverage, but it’s capped, taxed or contains limited features.

The odds of a disability are too high to risk a potential loss in income.

To protect high earnings from extended time spent in specialized training.

+ Example - doctors, dentists, attorneys, engineers, and others.

Some of the key items to look for in a disability insurance policy are::

1) Own Occupation Definition - If an individual cannot do the duties of what they do each day, but can in fact work another job, they would still collect their disability claim.

2) Increase Provisions - As an individual’s income grows, there are provisions that allow them to increase their disability insurance benefit in the future, with no medical underwriting.

3) Pay Period and Duration - For those who have long term disability insurance with their employer, it may not pay out for 180 - 365 days, once a disability claim is initiated. Employer plans may only pay a claim for a shorter duration of time, such as 5 or 10 years. Personal plans can pay at a faster rate, and for a longer term.

How Underwriting Works

When reviewing personal options for long term disability insurance, it starts with how much an individual is eligible for financially. This is a combination of total income, and any other disability insurance in place. For those who have no disability coverage, the maximum allowed will be substantially higher, in comparison to those who have employer group disability benefits.

In addition to how much coverage will be allowed, underwriting will also determine if all riders and features will be included in the disability insurance contract. This is based on current health status, prior health, and family health history. Pending certain health items, the provisions of the disability policy could be limited. In addition, any outstanding health items that may be considered a major risk to the insurance company, can be excluded from the contract altogether.

Designs Typically Reviewed, and Other Options to Consider

Below is the case study details being utilized for disability insurance samples to analyze and discuss:

+ Gender: Female

+ State: NH

+ Age: 35

+ Occupation: Radiologist

+ Group Disability Benefit: Capped at $5k monthly taxable benefit.

+ Personal Income Eligibility: $20k monthly tax free benefit.

***A highly reputable insurance company is being used for these designs.***

First Personalized Sample: Maximized Coverage

Benefit: $20k of Monthly Tax Free Indemnity

Elimination Period: 90 Days

Benefit Period: To Age 65

Partial Disability Rider Included

Annual Premium: $9,487

This design is created to replace maximum income loss due to a disability. If the disability is for two years, five years, or the rest of one’s career, the $20k monthly benefit, and their group benefit, would replace any lost wages. The coverage however, comes at a sizable premium. Whether the individual becomes disabled, or if their disability occurs later in their career and at a short duration, the cost of coverage could be substantial. For those who side on the error of caution, this could be a good option. For most however, insurance is typically viewed as a needs only basis, effectively trying to reduce how much premium is paid.

Second Personalized Sample: Needs Only Coverage

Benefit: $7,500 of Monthly Tax Free Indemnity

Elimination Period: 90 Days

Benefit Period: To Age 65

Partial Disability Rider Included

Annual Premium: $3,582

This design focuses strictly on protecting what expenses need to be paid each month. This includes a mortgage payment, utilities, groceries and a few other basic expenses. I used a conservative debt to income ratio, which was just under 40%. This sample is extremely helpful in keeping the cost of coverage low ($5,900 annual premium swing compared to max coverage). This sample is helpful on a short duration disability, however it can be detrimental to one’s family if a disability would last even a few years, especially in the peak of one’s career. Other savings and assets would need to cover any major differences for a longer disability.

Third Personalized Option: Meet in the Middle, but through a Different Concept

In the case where someone does not want to maximize coverage due to cost, but feel the minimum is not enough, it becomes a price point. How much is someone willing to pay, for the amount of coverage they will receive due to a disability?

With disability insurance, the price is relative. Whether you take all the coverage or the minimum, the price moves in a linear fashion. If an individual paid less than maximum coverage, and did not become disabled, they saved on premium output. On the flipside, if someone took less coverage, but were disabled for an extended period of time, their family would suffer financially because of it.

There is an additional concept to share that can help with the “in-between” decision on how much coverage makes sense, while keeping cost reasonable. Before comparing, here’s a few additional statistics to share:

+ When entering our 50’s, we are 3 - 5times more likely to become disabled, compared to our 30’s.

+ The most new long term disability insurance claims begin between our 50’s and 60’s.

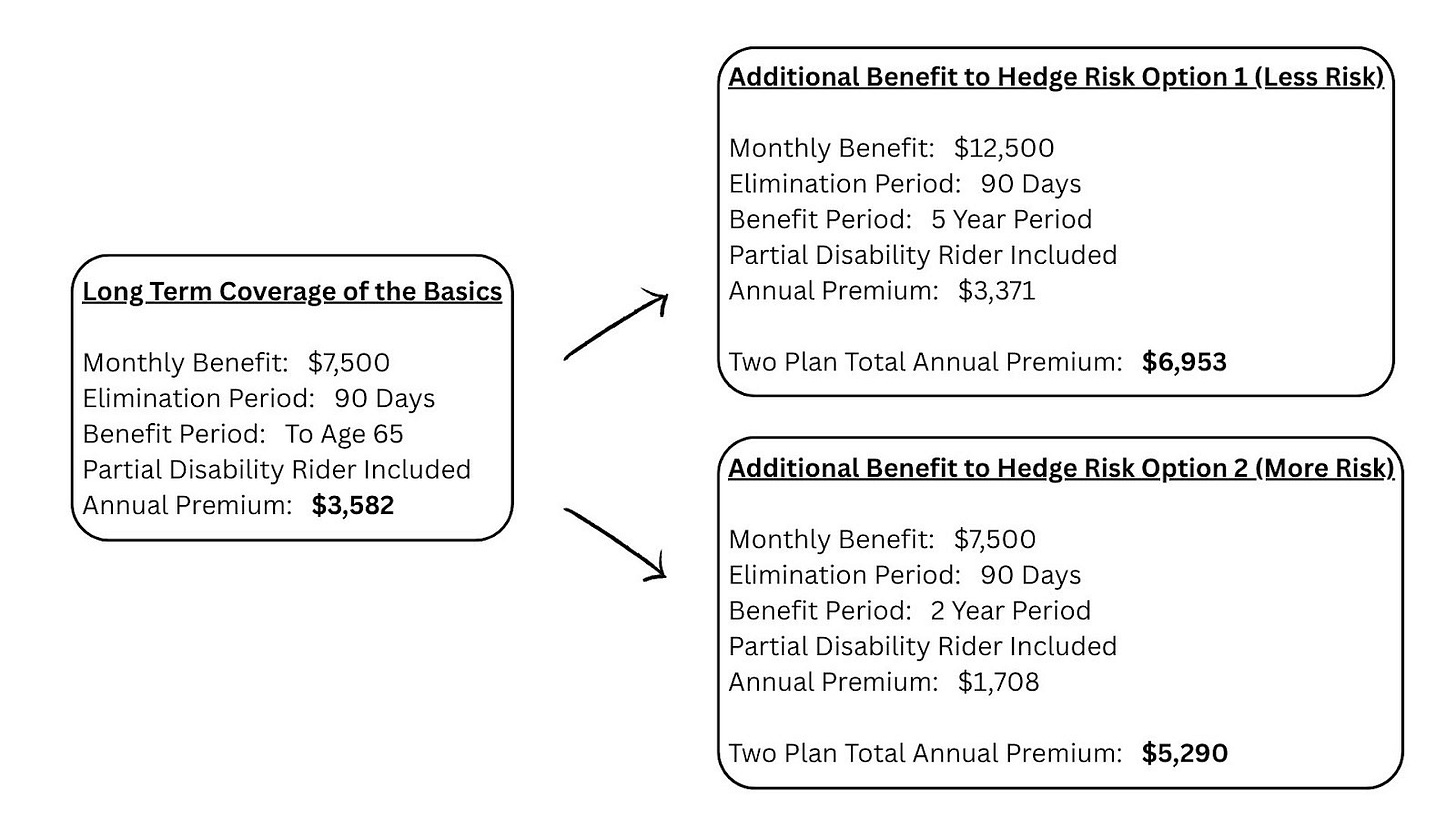

Instead of simply moving the coverage amounts up and down, we contemplate a design shift. Consider a two-policy strategy: One provides long-term foundational coverage, while the other helps protect against shorter term or later career disabilities, ensuring full coverage from day one. Below to the left there is the baseline design, with two potential options as add ons to complete the total coverage put in place.

Understanding the odds of a disability can be helpful when making decisions on personal planning. The chance of a disability is greater in our later working years, and the average disability length is 2 - 2.5 years. If an individual were to construct a disability insurance policy, and using those statistics in favorability, it’s possible to rethink how disability coverage can be designed.

Option 2 - This multiple policy approach carries higher risk for long-term disabilities (lasting more than two years). However, if an individual is disabled for two full years or less, close to the average, they would still receive maximum income replacement. This is achieved through a combination of a $7,500 monthly benefit to age 65 plan and a $12,500 monthly two-year benefit plan. The advantage of this structure is the cost savings. The combined premiums are $4,200 less annually than a single $20,000 monthly benefit plan. Over time, especially if the disability occurs later in the individual’s career, this difference in cost can be significant.

Option 1 - In comparison to Option 2, this multi policy design provides a longer runway for managing the risk of extended disabilities. If an individual were disabled for three, four, or even five years before returning to work, they would still receive the full $20,000 monthly benefit to replace their income. While the annual premium savings compared with the maximum plan are smaller, $2,500, the individual gains additional years of disability income if the disability was greater than 2 years.

A Few Other Insights on Design

There’s a few other reasons why it’s worth considering a different approach to disability insurance design.

1) Disability Later in one’s Career - If a disability were to occur in someone’s 50s, the financial burden is not as large. With 20-25 working years under one’s belt, that’s ample time to grow income, save for the future and pay down debts. Designing policies that still pay out during that time is helpful, but it can also effectively reduce premium output along the way.

2) How Long Coverage is Paid For - Consider a disability insurance policy that provides coverage up to age 65. In many cases, individuals may not maintain the policy until that endpoint. For example, someone who is a disciplined saver or receives a significant inheritance, might choose to cancel the policy in their early or late 50s once they achieve financial independence. This eliminates the need for additional years of disability coverage and reduces further premium payments.

3) Incentive - This reason may not be the most significant compared to the others discussed above, but for high-earning professionals, there is often a strong motivation to return to work. Doctors, attorneys, and similar occupations typically aim not only to provide a growing income for their families, but to continue the value they provide by serving the public. A shorter-duration disability insurance design can reinforce this motivation, as it provides coverage without a long-term income safety net that might otherwise reduce the urgency to resume their careers.

Final Thoughts

There is no perfect design when it comes to disability insurance. We cannot predict if, or when, someone will become disabled, nor the duration of any potential disability. The designs discussed above are intended to illustrate the available options and how they can be applied. This overview is not meant to suggest that one design is inherently superior to another. A policy is only truly tested if and when a disability occurs - either it provides the necessary coverage, or it does not. The key takeaway is that anyone reviewing options should be aware of the range of possibilities. Each person has their own financial philosophy, especially regarding insurance, so it’s important to explore both industry norms and alternative approaches.

*** The statistics listed above come from the Social Security Administration, US Census, and the Council for Disability Insurance Awareness.

*** The disability insurance designs that were built through Ameritas. However, the same designs can also be generated by many other great disability insurance providers.